Crypto Term – 401(k) Plan A 401(k) plan is a retirement savings program sponsored by American companies where employees contribute a portion of their income and the employer matches the contributions.

In the United States, a 401(k) plan is an employer-sponsored defined contribution personal pension (savings) account, as defined in Section 401(k) of the Internal Revenue Code.

Regular employee contributions come directly from paychecks and can be matched by the employer. This legal option makes 401(k) plans attractive to employees, and many employers offer this option to full-time employees.

401(k) Payments is a general ledger account that contains 401(k) plan pension payments that must be remitted by the employer to the pension plan administrator. This account is classified as a payroll liability because the amount due must be paid within one year.

What is a 401(k) plan?

401(k) is a retirement program offered by employers in the United States. 401(k) plans allow employees to receive a tax break on the funds they contribute. Contributions are automatically deducted from your salary. They are then invested in funds that the employee selects from the available list.

However, some 401(k) management companies do not allow employees to choose where their money is invested. In either case, this will be accounted for when the employee signs up for the plan. The benefit limit for 401(k) plans is $20,500 per year in 2022, or $27,000 if you are age 50 or older.

The plan’s name comes from subsection 401(k) of the tax code that established it. Employees subscribe to automatic deductions from their paychecks to contribute funds to their personal accounts.

History

Before 1974, several U.S. employers offered employees the option of receiving cash in lieu of employer contributions to a tax-qualified retirement plan account. The U.S. Congress banned new plans of this type in 1974, pending further study. After the study was completed, Congress reapproved the plan if it met certain special requirements. Congress did this by enacting Section 401(k) of the Internal Revenue Code as part of the Revenue Act. This happened on November 6, 1978.

The first implementation of 401(k) plans was in 1978, about three weeks after Section 401(k) was enacted and before the Revenue Act of 1978 took effect. Ethan Lipsig, an outside law firm for Hughes Aircraft Company, sent a letter to Hughes Aircraft explaining how it could convert its after-tax savings plan to a 401(k) plan.

Ted Benna was one of the first people to establish a 401(k) plan, creating one for his employer, Johnson Companies (now doing business as Johnson Kendall & Johnson). At the time, employees could contribute 25% of their salary (up to $30,000 per year) to their employer’s 401(k) plan.

How to Get a 401(k)

Your employer offers a 401(k) plan. Unfortunately, not all employers offer this. In this case, you can still benefit from an individual retirement account.

What are the benefits of a 401(k) plan?

One of the most obvious benefits is that most employers will match a portion of the amount you contribute to the plan. Some will match your donation dollar for dollar, while others will only match it by a certain percentage.

Employers may also provide non-elective contributions. This means you can decide to provide a percentage into the plan for all workers, regardless of whether they invest the money. For example, an employer may choose to contribute 3% of an employee’s salary annually to the plan.

Another option used by employers is profit-sharing contributions. In this case, they will provide a set dollar amount for a money-making scheme. Various formulas are used to determine how the amount is shared among different employees.

There are many different types of 401(k) plans. The main ones are Traditional 401(k) and Roth 401(k). Traditional 401(k) plans offer upfront tax breaks on contributions. In contrast, a Roth 401(k) is an after-tax contribution. This means it’s time to withdraw your funds. The IRS doesn’t cut your money.

If you decide to leave your current job, you can take your 401(k) contributions with you. Instead of putting it in a box when you leave your job, it’s rolled over to a new account you work with your new employer. 401(k) rollovers are relatively simple and your bank can help you.

Can I invest in Bitcoin through my 401(k)?

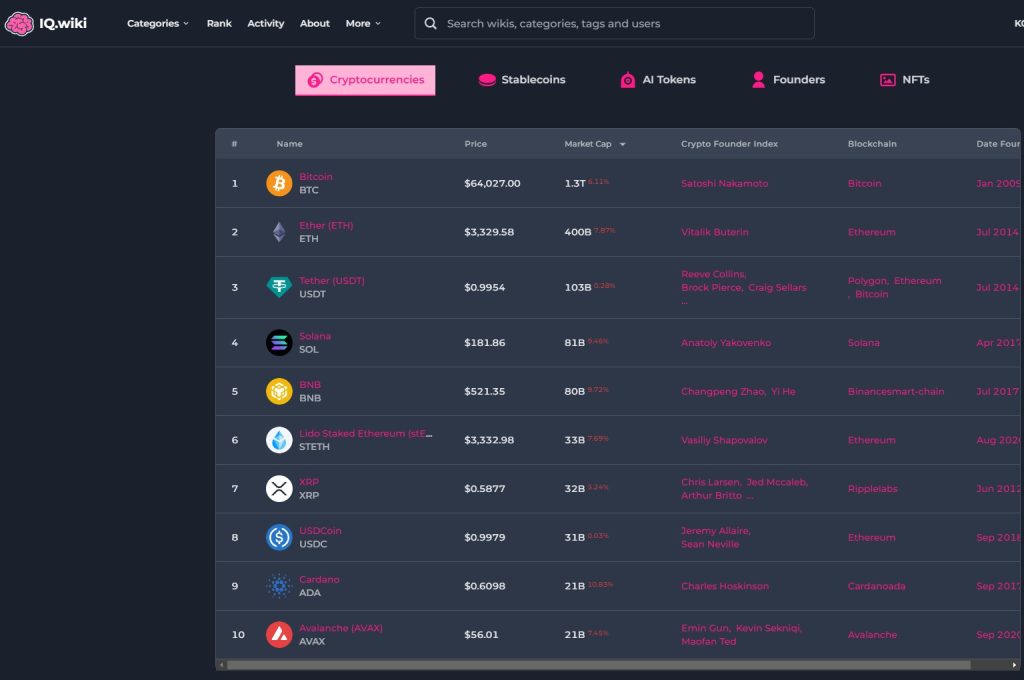

As the popularity of cryptocurrency and blockchain technology increases, many people choose to invest in Bitcoin through 401(k). Recently, this became possible thanks to Fidelity Investments, one of the most important players in the 401(k) industry. The company announced in April this year that it would allow investments in BTC.