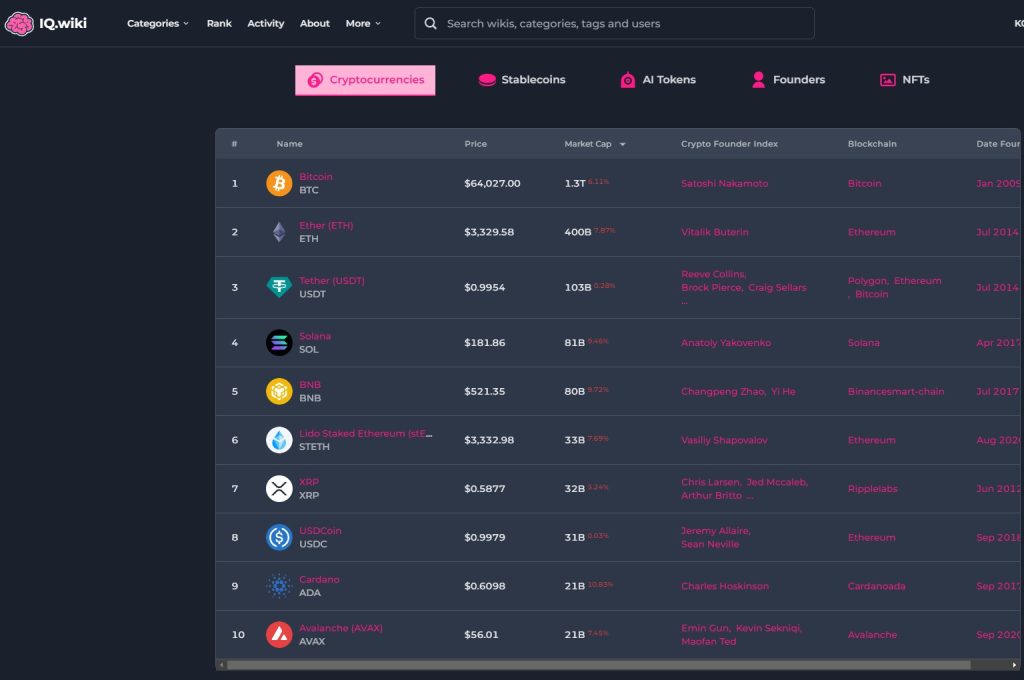

48% return if purchased at the beginning of the year

“9 out of 10 Bitcoin holders reap profits”

Bitcoin, the leading cryptocurrency, continues to rally even after hitting an all-time high. This shows that ‘today is the cheapest day’ every day. About 12% (11 million won) remains until 100 million won, which is considered the next resistance level.

According to the industry on the 29th, Bitcoin recorded an increase rate of 10% for the first time this year. Even though it broke the all-time high of 82.7 million won the previous day, the steep rise continued.

The price range is expected to exceed 89 million won. As of 3 PM on this day, Bitcoin is trading at 88.9 million won, up 1.44% from the previous day. Before 9 a.m., the Upbit price reset time, the increase rate was 10.66%.

This is a 48% increase compared to the beginning of the year. If you purchased 10 million won of Bitcoin on the 1st of last month, you would have made a profit of 4.8 million won. At the beginning of this year, the price of Bitcoin remained in the low 60 million won range.

Even though Bitcoin has jumped nearly 50% in two months, expectations for further increases have not subsided. There are many predictions that it will soon reach 100 million.

This outlook is supported by the analysis that the purchase demand from large US institutions fueled this bull market. The explanation is that it can be seen as the beginning stage of a bull market, given that new individual investors have not yet entered.

“Recently, the trading volume of nine U.S. Bitcoin spot ETFs reached an all-time high,” said Ryan Lee, senior analyst at BitGet Research. “This suggests that institutional buying sentiment is strong.”

He continued, “We expect Bitcoin to surpass the all-time high of $69,000 (KRW 91.99 million) and record a new high next month due to institutional buying demand and the Bitcoin halving.”

SimonaD, a crypto quant analyst, said, “One of the conditions for a sustainable bull market is the inflow of new investors,” and added, “Given that the inflow of these investors is not yet large, it appears to be in the early stages of a rally.”

He then predicted a further rise, saying, “There is a possibility that institutional investors will continue to flow in to hold Bitcoin in the future.”

In fact, as intraday Bitcoin ETF trading volume increases, demand for purchasing Bitcoin spot in the over-the-counter market (OTC) increases after the market closes. This has the effect of encouraging price increases.

Among these, it was calculated that 9 out of 10 Bitcoin holders made profits due to the recent upward trend. On the 28th (local time), Into the Block, a virtual asset analysis company, reported through